When it’s time to make decisions regarding paying your employees, you probably want whatever’s easiest. You don’t want to spend days scouring through the multitude of payroll systems available; you don’t want to read through lengthy studies explaining how you should structure your pay calendar; and you probably don’t want to have to schedule more than a few meetings to discuss it.

Like everything else, modern financial technology is revolutionizing the way we pay employees. New companies are creating systems and processes that are cheaper and easier for both you and your employees - and one of the hottest debates is whether on-demand pay is a good idea.

How Often Should You Pay Employees?

In recent years, the gates have been pushed open for conversations about pay frequency. It has been standard in America for years to pay employees about every 14 days. These decisions have to take into account federal and state laws, payroll costs, etc.

Companies are required to pay at regular intervals (you can’t pick a random day each month). Additionally, some states have their own regulations (for example, Arizona and Maine require that employees are paid at least every 16 days).

You shouldn’t change your pay structure often. It’s a big decision that will affect all of your employees and the way they set budgets. Today, there is a way to give your employees on-demand access to their pay without having to change your pay structure at all.

On-Demand Pay Programs

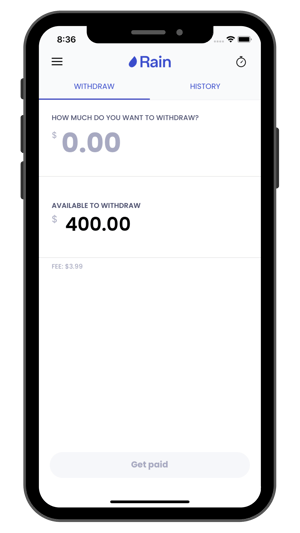

On-demand pay vendors can connect to your payroll and timekeeping systems (if applicable) to allow your employees to withdraw immediately after a shift or any day before payday. These programs set limits (usually 50% of earned wages) so that payday stays the same and all federal and state regulations are met.

By using an on-demand pay vendor, your employees get the flexibility to use their own money whenever they need it, but your team doesn’t have to spend hours sorting through pay schedules and advances. At the same time, you don’t have to make any changes to your payroll or timekeeping systems.

Oasis has partnered with Rain Instant Pay to bring early wage access (another phrase for on-demand pay) to as many employers as possible. It’s free for employers to sign up, so why not try it?

Click here to let the Rain team know you’re interested in scheduling a demo.

Best Way to Pay Employees

On top of pay frequency, you may be wondering about the best way to pay your employees. You may think the days of having to write paper checks are gone, but some of your employees may not have traditional bank accounts that allow them to receive direct deposits. According to the American Payroll Association, about 10% of U.S. employees are “unbanked,” with most working in food service, hospitality, and agriculture.

On top of pay frequency, you may be wondering about the best way to pay your employees. You may think the days of having to write paper checks are gone, but some of your employees may not have traditional bank accounts that allow them to receive direct deposits. According to the American Payroll Association, about 10% of U.S. employees are “unbanked,” with most working in food service, hospitality, and agriculture.

In response, pay cards have become a popular option for some employers. Even employees with traditional bank accounts sometimes prefer to use pay cards as a budgeting tool. Having a pay card is like having a debit card - except that you can’t reload that card by anything other than your wages (in most cases), so it forces you to keep some of your money separate.

The on-demand pay revolution is now incorporating pay cards. If you have several unbanked employees or are looking for a more modern approach to payroll, you might want to consider an on-demand pay solution like Rain. Employees can use Rain pay cards like a direct deposit debit account. Plus, they can have money added to their pay card any day of the week instead of having to wait for payday.

How to Introduce More Frequent Pay

Introducing a program like Rain or any change to your current payroll processes can be scary for your employees, so it’s important to introduce it carefully.

If you need to change your pay cycle, it’s important to give your employees plenty of advanced notice (at least one or preferably two months) so that they can plan accordingly (especially if you’re going to start paying less frequently). Your employees, especially those who have been with you for a long time, have likely been planning their budgets and lifestyles according to your current pay schedule. Disrupting that can have long-lasting consequences on their finances.

If you need to change your pay cycle, it’s important to give your employees plenty of advanced notice (at least one or preferably two months) so that they can plan accordingly (especially if you’re going to start paying less frequently). Your employees, especially those who have been with you for a long time, have likely been planning their budgets and lifestyles according to your current pay schedule. Disrupting that can have long-lasting consequences on their finances.

Using an app like Rain that gives people full control over their wages and when they receive them can be much easier than changing your pay date or the length of your pay cycle. That way, even if you have to start paying less often, your employees can use your on-demand pay program to take out “advances” against their next paycheck. The pay cycle change would have a much smaller impact on their wallets.

If you’re interested in signing up for Rain, use this link to get started.